Mumbai based Online Insurance player Acko General Insurance raised $65 Mn in its Series C round from Flipkart’s co-founder Binny Bansal, Kabir Misra from RPS Venture, Intact Ventures (the corporate venture arm of Canada’s largest property and casualty insurer) and its existing investors.

The existing investor’s panel includes Amazon, SAIF Partners, TechPro Partners, and Accel Partners.

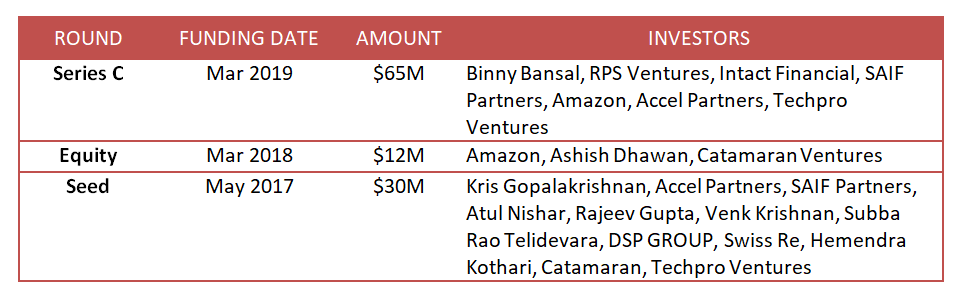

After adding the Binny Bansal’s share of $25 Mn in this round, total funds raised by the Acko stands at $107 Mn. Acko came into the limelight when it raised the highest Seed Funding of $30 Mn in May-2017 even before the launch of the product.

Acko so Far

Varun Dua, co-founder of Coverfox launched Acko in 2016 which focuses on online-only Insurance. Acko majorly deals in bite-sized insurance products such as car comprehensive insurance, car third party insurance, mobile and appliance protection, and ticket cancellation etc. Acko is in partnership with 15+ leading players in the internet ecosystem such as Amazon, Ola, redBus, UrbanClap, and Zomato. Acko is in direct competition with Easy Policy, Policy Bazar and Paisa Bazar.

The company has participated in 3 funding rounds so far:

After raising the fresh funds in the advisory of Avendus Capital, the valuation of the company reaches $300Mn and put it under the category of Soonicorn.

Investor’s Corner

Technology led insurance is expected to play a significant role in the growth of the underpenetrated insurance sector in India. Acko is the pioneer of digital-native insurance and I am delighted to partner in its exciting growth journey

– Binny Bansal, Co-Founder Flipkart & Xto10X

Considering the growth of the company, Acko has distributed the insurance policies to over 20 million customers in just 12 months. Acko is also planning to launch health and travel insurance at the end of 2019.

We have strong conviction on the ensuing insurtech wave and more specifically, in India, which is hugely under penetrated and suffers from multiple gaps. We are excited to support Acko, which is transforming insurance through technology and data-based underwriting and a unique customer-centric approach.

– Kabir Misra, Managing Partner at RPS Ventures

In addition to their innovative direct-to-consumer strategy, Varun and his team have taken a creative approach by developing impactful distribution partnerships that allow millions of customers to protect assets that are meaningful to them.

– Karim Hirji, Senior Vice-President of Intact Ventures

Acko is using the tech notch steps to make the process of insurance online. According to the Varun Dua:

India’s non-life insurance market is worth about $25 billion and is growing at 15-20% compounded annually. About 6% of this is online.

The current round of funding demonstrates the confidence investors have in us and in our ability to transform how insurance will be delivered. This round of funding will put the company on a rapid growth trajectory.

No Comments